What Is FDV In Crypto

What is FDV in crypto, and why is it important for investors to understand? In this article, we’ll break down what FDV means, how it's calculated, and why it matters. We’ll also explore real examples, point out common mistakes, and answer the most asked questions.

FDV, or Fully Diluted Valuation, is an approximate equivalent of a cryptocurrency's market capitalization if a hypothetical event occurred where the token supply was fully circulating. It's nothing more than a multiplication of the token value by the max supply of the token.

That's a simple formula

FDV = Price of token x Max Supply. For illustration purposes, assuming that a token has a cost of \$2 and a supply limit of 1 billion tokens, then the FDV of the token will be \$2 billion. That's the hypothetical market value of the project if every token is brought into circulation. It's not the value today but a potential value in the future.

Why FDV Matters to Crypto Investors

Therefore, why are you drawn to FDV in cryptocurrency? Imagine purchasing a token under the premise that its market cap appears small, to later discover the project has a strategy to produce 90% more tokens. That has the potential to lead to enormous value drops by means of supply pressure. FDV alerts you to the potential surprises. It also tells you how large the project*could* turn out to be assuming all the tokens are unlocked. Market capitalization is measured based on what exists, whereas FDV presents you with the larger picture. It's especially beneficial to compare between two projects. It could appear cheaper on the surface but turn out to have a significantly larger FDV, so there will turn out to be more token inflation.

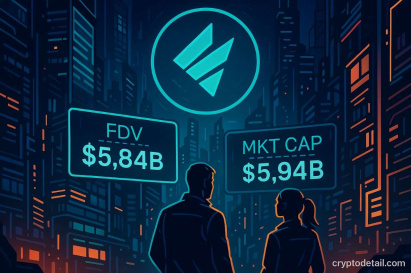

FDV compared to Market Cap: How are they different?

Most individuals equate FDV with market capitalization but they are not alike. Market capitalization = Price of token × Circulating supply. Max Supply = FDV / Token Price. Let's assume that a project has

* Total circulating token supply of 100 million

* Total supply of 1 billion tokens

* A token value of $1

Market Cap = $1 × 100 million = $100 million

FDV = $1 times 1 billion = $1 billion

It's the amount of tokens that are reserved or locked. A big discrepancy usually means that a larger amount of tokens are to be received, and that can affect the price if not managed correctly.

Where FDV can lead you astray

FDV is a useful tool, but no tool can ever be infallible. Indeed, FDV can also turn out to be misleading. Here's why

- Unlock token schedules: The tokens are not delivered at once. The majority of ventures have vesting schedules that unlock tokens gradually. FDV can appear staggering, but it actually has a delayed impact of years.

- Low Liquidity: A token with low liquidity has a tendency to easily manipulate its value. Price of token is used to derive FDV, not the value of a project.

- Speculative Pricing: There is still a discovery of the price at the beginning of a project's life. The token value isn't necessarily representative of true demand, and multiplying by max supply could produce unrealistic FDV. Always look to the vesting schedule and get to know a project's tokenomics before relying entirely on FDV.

Real life examples of FDV in action

Let's examine a pair of real-life examples:

- Arbitrum (ARB): There weren't a lot of tokens out there in circulation when it launched. Its market cap was around \$1 billion, but FDV was over \$10 billion. That informed investors that there were a lot of tokens still to come out.

- Optimism (OP): The same case. It had a much greater FDV than market cap, prompting investors to raise questions over long-term pricing stability.

- Aptos (APT): When the token was launched, just 15% of the total supply was unlocked. There was a possibility that subsequent token releases could devalue the token, even after the initial hype.

Who uses FDV and why

FDV is predominantly used by

* Retail Investors: To compare projects so that we will not fall into the trap of the token value going down because of token releases that are not expected.

* Venture capital companies: To forecast how large the returns will be based on expected valuations.

* Data Aggregators: FDV is reported by sites like CoinGecko, CoinMarketCap, and Messari as a normal metric to provide the user with a larger context of project valuations.

* Project Teams: While there are those who advocate FDV as a growth signal, others attempt to distance themselves from FDV when investors are worried about inflation.

FDV is not a number in and of itself - it's a signal. Whether you read it or not, though, depends on where you are in the ecosystem.

Role of tokenomics in FDV

FDV does not exist in isolation. It is highly connected to a project's tokenomics, which entails

* Vesting Durations: The tokens can be vested and released after years or months.

* Team Allocations: The size of the holding percentage by the founders will influence the future value.

* Reward and Incentives: Programs tend to hold back tokens in expectation of staking, liquidity mining or building a community.

These influence how fast the entire supply can come into the market, and how that can influence the pricing. It's not just a question of how many tokens are arriving, but to whom and when.

How to Use FDV in Your Crypto Analysis

Here are some tips:

1. MCap to FDV ratio: Low MCap with a very high FDV? Check the unlock schedule. High inflation may not be too far away.

2. Read whitepaper: Check to see if there's a token release schedule. It's a 1 year or 4 year difference. That's a pretty big difference.

3. Utility: Do we want the token to serve a utility function to the platform, or is it just a reward? High utility has the potential to create sustained demand.

4. Hype versus Reality: Because FDV is large does not imply that the project will actually turn out that way. Be realistic.

5. Keep Up to Date: The token economics may alter. Pay heed to proposals regarding governance and project announcements. FDV is just part of the puzzle. Put the rest of the tools into it to make it clearer.

Conclusion

Full Diluted Valuation is part of the most important metrics that demonstrate how a cryptocurrency project is worth if everything that exists within it is out in circulation. It allows investors to look past the market capitalization and anticipate future shifts in supply. Although FDV can provide a great deal of insights, it isn't a crystal ball. It also has to be looked at in context, including tokenomics, vesting tables, and actual use cases. Knowing how FDV operates and how to read into it translates to the ability to make smarter decisions and not make the usual errors.

FAQ

1 - Is FDV larger than market capitalization?

They're not mutually exclusive of one another. Market cap is current value out of circulating supply. FDV is potential future value of unfurled supply. Use them together to see the whole picture.

2 - Can FDV impact token value?

Yes. A token of large FDV with limited circulating supply can see selling pressure of large future unlocks to reduce the price.

3 - How do I know a token's FDV?

Look at a place like CoinGecko or CoinMarketCap. Either will typically have FDV accompanied by market cap and supply values.

4 - Should I avoid tokens with a high FDV?

Not always. A high FDV can signal future growth or risk. What matters more is how the remaining tokens are released and what they’re used for

5 - Do I apply FDV to all sorts of crypto projects?

Nearly exclusively for capped supply tokens. For no hard cap tokens (inflationary coins), FDV isn't of much value because there isn't a set max supply.

Scroll to top

Scroll to top